Repayments via ACH:

Loan servicing enhancement

Launched Q4 2019

Objective

Introduce flexibility for merchants to make ad hoc payments via ACH (bank account) on a loan structured around automated, sales-based repayments.

This project was one of several feature enhancements meant to lay the groundwork and prepare the PayPal Working Capital framework to sustain enterprise solutions that would allow PayPal to approve and lend to a wider population of small business merchants.

My role

Lead designer

Platform

Responsive web

Skills

Information architecture, interaction design, usability testing, dev collaboration

Background

Because repayments are automated from the merchant’s PayPal sales transactions, everything about the legacy Working Capital loan product was designed to operate via the merchant’s PayPal balance. Although merchants have the ability to make ad hoc payments in addition to their automated sales-based repayments, extra payments can only be paid from the merchant’s PayPal balance, which means they can only submit and process in real-time.

As a result, merchants carrying an insufficient balance would need to transfer money from their chosen bank account into their PayPal balance before making a payment. This process can take up to 3 days and frequently results in merchants missing intended payments.

Challenge

The Working Capital loan servicing experience exists on a microsite a step removed from the main PayPal account experience. As a result, key flows such as money transfer and bank account linking cannot be accessed from the loan servicing dashboard. The disconnect from the main PayPal experience introduces jarring disruptions that are difficult for merchants to recover from.

Unfortunately at the time of this project, design led discussions to integrate the loan servicing experience could not be supported by the tech stack.

Goals

-

Introduce the ability for merchants to use an already linked bank in their PayPal wallet as the payment method for an ad hoc loan repayment.

-

Provide new functionality that would allow merchants to schedule future dated payments from their bank account.

Research

We knew from an ongoing series of foundational research studies that time and cash flow are of the utmost concern for merchants when it comes to managing their business and business loans.

Cash flow

-

Many merchants move surplus funds from their balance to their bank for bookkeeping reasons.

-

Some merchants calculate down to the hour in terms of when payments can process.

-

Any payments too soon or too late may result in insufficient funds which can snowball into additional fees.

Time + Timing

-

Merchants are busy and want to dedicate as little time as possible to managing their loan.

-

For many sole proprietors, tasks are completed when top-of-mind so a 3 day waiting period for a funds transfer can be very disruptive.

Final Solution

Step 1:

Choose an amount

Lead with payment amount since we know merchants tend to think about things in terms of cost, and choice of funding instrument used is influenced by the amount needed.

Do the math for the merchant and serve key calculations such as outstanding balance, and remaining minimum due as options the merchant can select quickly.

Support payment flexibility by continuing to provide custom amount field for ad hoc payments.

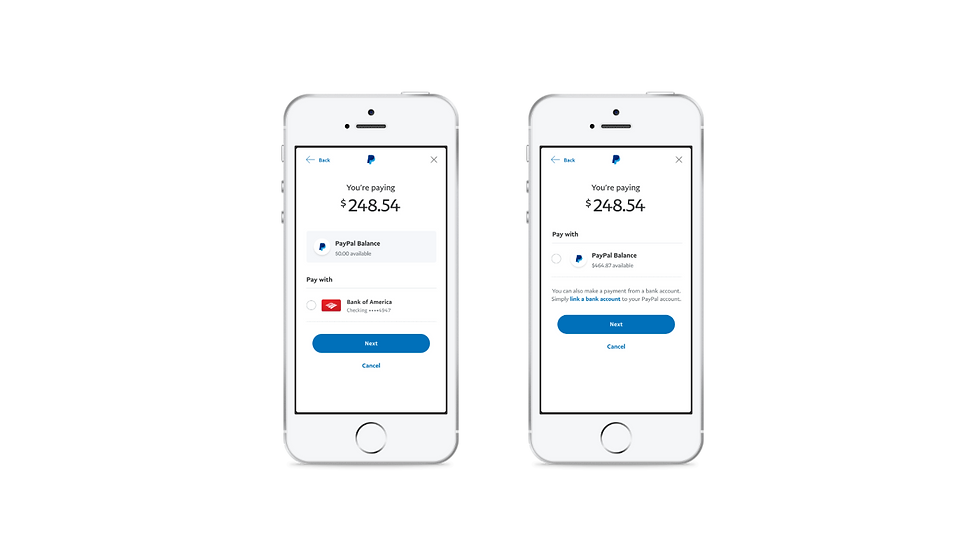

Step 2:

Choose payment method

Persist the payment amount on the payment method step so merchants can easily cross-check their account balances without leaving this screen.

Step 2 scenario:

Insufficient balances

Allow merchants to proceed with a partial payment even if their balance is insufficient for the selected amount.

In the absence of split pay capabilities, we did not want to hinder merchants from completing an intended payment.

Always display the balance even when zero balance.

This is the first instance of this loan working with a payment method besides balance so they should have a clear understanding of why it’s not available.

Limit instances of ‘link a new bank’ to use cases where no bank is available (for now).

96% of borrowers have at least one bank linked to their PayPal wallet, so with the experience disconnect, we limit redirects to that flow for the time being.

Step 3:

Choose a date

Provide simple date selection for payments paid from a bank account so that merchants can plan ahead and better manage cash flow and timing while a task is top of mind.

Step 4:

Review Payment

Step 5:

Success Confirmation

Provide opportunity to review and confirm payment prior to submittal to help reduce mistakes on real-time payments.

Reiterate payment method and date at this point so merchants can proceed with bookkeeping measures if needed.

Scheduled payments tracking

Introduce new ‘Scheduled payments’ table so merchants can track and maintain awareness of upcoming payments.

Provide a summary of all scheduled payments so a high-level understanding can be gleamed at a glance.

For context, show the original date a payment was scheduled, and allow merchants to cancel payments anytime before the scheduled date.

Results

Following the launch of ACH, PayPal Working Capital saw a significant increase in Total Payment Volume. Total ramp expectations of $920K were exceeded within the first two weeks of the ramp period.

The average Total Payment Amount of ACH payments ($1,047) is significantly higher than the average Total Payment Amount for balance payments ($670).

Most importantly, this feature laid the groundwork to integrate an acquired term loan product into this homegrown framework and enable access to future enterprise solutions.